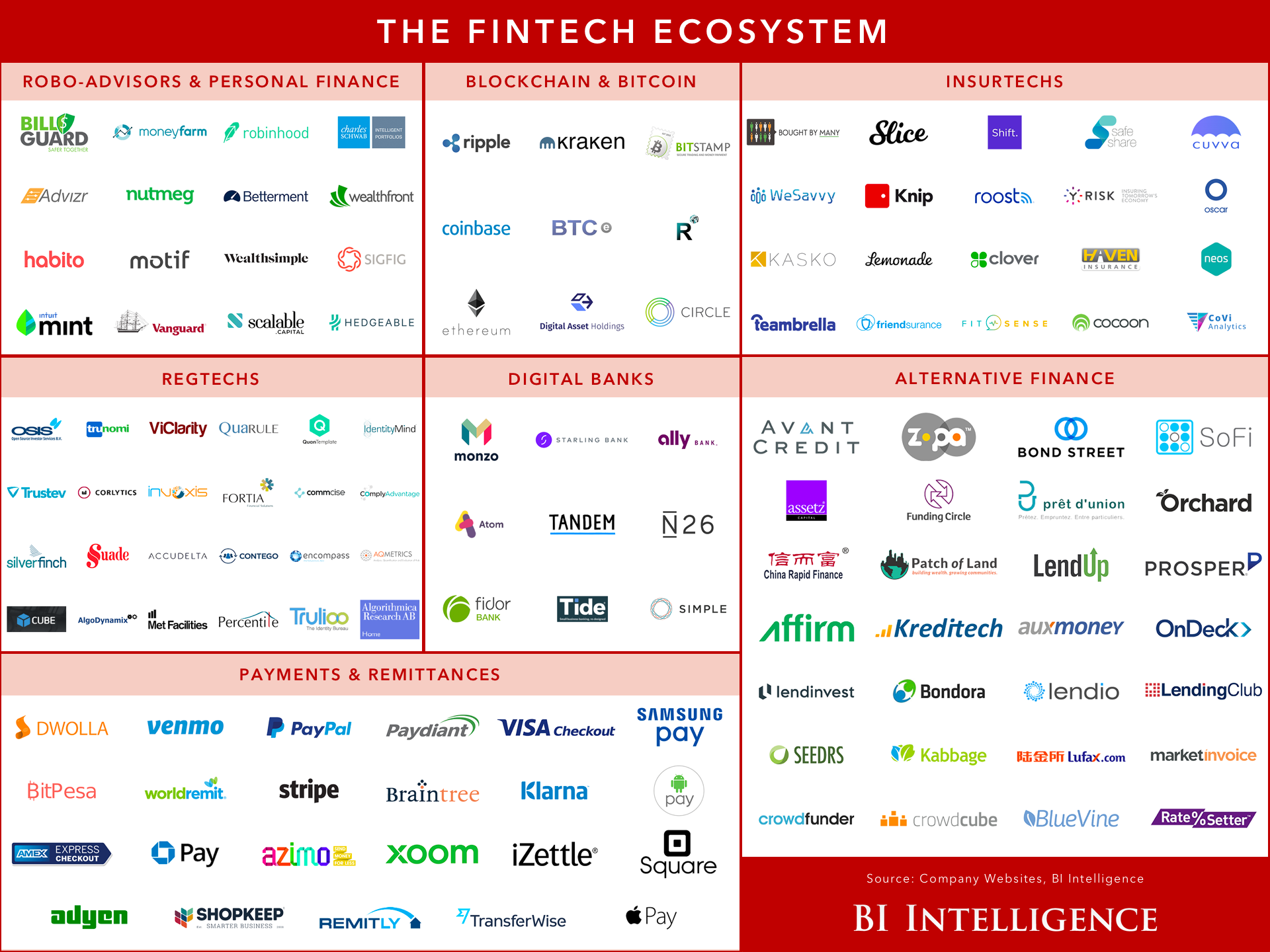

Those that serve consumers directly and those that serve businesses and government organizations. Fintech is an industry made up of companies that use technology to make financial services more efficient.

What Are Examples Of Fintech Companies, Here are different types of software you can build for the lending category. The bank has developed personalized insights about.

Apart from the four categories above, let’s focus on some of the most popular examples that will make fintech easier to understand. Fintech is a broad category that encompasses many different technologies, but the primary objectives are to change the way consumers and businesses access their finances and compete with traditional financial services. Through the leading fintech apps, fintech companies provide consumers to go online and see their financial transactions. This gives smaller companies and individual entrepreneurs easier access to capital.

What are examples of fintech?

It provides payment services to about 3.500 businesses, including facebook, uber, and airbnb. Their product doubles as a marketing strategy for merchants to acquire customers and allow them to pay later. Some such as financial strategies (examples) are following; Various fintech companies such as personal capital, lending club, wealthfront have emerged in past decades while rendering new strategies on financial notions and making users allowed to hold more viable financial outcomes. So how is fintech being used in 2020, and what are. Fintech is an industry made up of companies that use technology to make financial services more efficient.

Source: weforum.org

Source: weforum.org

It is a virtual fundraising network that enables users to receive or send money via apps. Fintech has a seemingly endless array of applications. It uses algorithms and machine learning with artificial intelligence, to offer personalized personal loans. Here are examples of fintech companies that have crafted smart facebook ads to reach their desired users. Examples of international fintech companies.

Source: gomedici.com

Source: gomedici.com

Here are examples of fintech companies that have crafted smart facebook ads to reach their desired users. But apart from budgeting apps, what are other uses of fintech? The bank has developed personalized insights about. Kabbage and borrowell are great examples of fintech lenders. What are examples of fintech?

Source: gomedici.com

Source: gomedici.com

Fintech is an industry made up of companies that use technology to make financial services more efficient. Particular growth areas are in europe, including london, amsterdam, stockholm and lithuania, and asia, where. 6 innovative projects between banks and fintechs n26 and transferwise. It is a virtual fundraising network that enables users to receive or send money via apps. Here are.

Source: guerric.co.uk

Source: guerric.co.uk

There are two types of fintech companies: Klarna is a fintech company that allows shoppers to buy products now, and pay for them later with no interest. What are some fintech companies in india? It provides payment services to about 3.500 businesses, including facebook, uber, and airbnb. Some examples of fintech are mobile banking, mobile payments, trading, cryptocurrency,insurance, trading, lending.

Source: thefinanser.com

Source: thefinanser.com

Through the leading fintech apps, fintech companies provide consumers to go online and see their financial transactions. For example, to encourage innovation, asic established a regulatory sandbox to allow fintech companies to develop and test products and services in a limited environment before getting a licence. What are the examples of fintech? As a result, interest in investing in and.

Source: thefinanser.com

Source: thefinanser.com

Below are some examples of companies that have successfully implemented fintech data science in their business operations. Here are 6 examples of banks and fintechs collaborating for innovation. Payments, lending, wealth management, insurtech, neo banking, and blockchain are all examples of fintech segments. Some examples of fintech are mobile banking, mobile payments, trading, cryptocurrency,insurance, trading, lending to name a few..

Source: nanalyze.com

Source: nanalyze.com

The company is assisting three billion new consumers in building credit. Here are different types of software you can build for the lending category. Paytm payments bank (paytm wallet; To precisely know what is fintech, one must know its traditional uses. What are the examples of fintech?

Source: malonepost.com

Source: malonepost.com

Particular growth areas are in europe, including london, amsterdam, stockholm and lithuania, and asia, where. Fintech is a broad category of companies that apply new intelligent technology to financial industries for their improvement. Below are some examples of companies that have successfully implemented fintech data science in their business operations. It uses algorithms and machine learning with artificial intelligence, to.

Source: shuftipro.com

Source: shuftipro.com

Here are 6 examples of banks and fintechs collaborating for innovation. Harshil and shashank founded razorpay in 2014 after discovering that conventional payment gateways were challenging to integrate. What are some fintech companies in india? Shoppers can buy products from asos, topshop and other online stores and try clothes on before they buy. Fintech has a seemingly endless array of.

Source: businessinsider.com

Source: businessinsider.com

As one of europe’s fintech unicorns, the company knows the value of building quickly using partnerships and collaboration. Top three companies for fintech lending software. Particular growth areas are in europe, including london, amsterdam, stockholm and lithuania, and asia, where. Wayfair, nordstrom and spending tree are just a few of the companies that use suplari’s platform to analyze, predict and.

Source: dataconomy.com

Source: dataconomy.com

It is a booming area, with global investment growing by over 2,200% between 2008 and 2015 and was worth us$22billion by the end of 2015. As a result, interest in investing in and partnerships with fintech companies has become increasingly. Some examples of fintech are mobile banking, mobile payments, trading, cryptocurrency,insurance, trading, lending to name a few. Here are different.

Source: cekindo.com

Source: cekindo.com

This gives smaller companies and individual entrepreneurs easier access to capital. Trusted by over 402 million wallets, it has handled over 100 million transactions involving users from 140 countries. Some examples of fintech are mobile banking, mobile payments, trading, cryptocurrency,insurance, trading, lending to name a few. Here are examples of fintech companies that have crafted smart facebook ads to reach.

Source: fintechnews.sg

Source: fintechnews.sg

Shoppers can buy products from asos, topshop and other online stores and try clothes on before they buy. For example, to encourage innovation, asic established a regulatory sandbox to allow fintech companies to develop and test products and services in a limited environment before getting a licence. As we know, it’s a mix of the words finance and technology. Top.

Source: devbridge.com

Source: devbridge.com

Harshil and shashank founded razorpay in 2014 after discovering that conventional payment gateways were challenging to integrate. What are some fintech companies in india? Top three companies for fintech lending software. German neobank n26 is no stranger to fintech. Some examples of fintech include mobile phone banking, cryptocurrencies and blockchain utilisation.

Source: blogs.mulesoft.com

Source: blogs.mulesoft.com

It uses algorithms and machine learning with artificial intelligence, to offer personalized personal loans. There are two types of fintech companies: It offers features like social connections, texts, calls and bill payments to determine creditworthiness; As a result, interest in investing in and partnerships with fintech companies has become increasingly. The bank has developed personalized insights about.

Source: letstalkpayments.com

Source: letstalkpayments.com

Here are different types of software you can build for the lending category. As we know, it’s a mix of the words finance and technology. As a result, interest in investing in and partnerships with fintech companies has become increasingly. Trusted by over 402 million wallets, it has handled over 100 million transactions involving users from 140 countries. But apart.

Source: gomedici.com

Source: gomedici.com

Apart from the four categories above, let’s focus on some of the most popular examples that will make fintech easier to understand. Shoppers can buy products from asos, topshop and other online stores and try clothes on before they buy. Their product doubles as a marketing strategy for merchants to acquire customers and allow them to pay later. Here are.

Source: gomedici.com

Source: gomedici.com

For example, to encourage innovation, asic established a regulatory sandbox to allow fintech companies to develop and test products and services in a limited environment before getting a licence. Payments, lending, wealth management, insurtech, neo banking, and blockchain are all examples of fintech segments. This gives smaller companies and individual entrepreneurs easier access to capital. Paytm payments bank (paytm wallet;.

Source: fintechnews.sg

Source: fintechnews.sg

It uses algorithms and machine learning with artificial intelligence, to offer personalized personal loans. Finance, procurement and operations departments can all use the company’s platform to analyze spending trends, hit savings goals and even find areas where money is being inefficiently spent. Below are some examples of companies that have successfully implemented fintech data science in their business operations. Global.

Source: venturescanner.com

Source: venturescanner.com

6 innovative projects between banks and fintechs n26 and transferwise. Wayfair, nordstrom and spending tree are just a few of the companies that use suplari’s platform to analyze, predict and cut down on costs. Global venture capital invested $12.2 billion in fintech companies in h1 2020. Klarna is a fintech company that allows shoppers to buy products now, and pay.

Source: financesonline.com

Source: financesonline.com

Various fintech companies such as personal capital, lending club, wealthfront have emerged in past decades while rendering new strategies on financial notions and making users allowed to hold more viable financial outcomes. What are some fintech companies in india? Here are examples of fintech companies that have crafted smart facebook ads to reach their desired users. Here are 6 examples.

Source: wolf-wolf.net

Source: wolf-wolf.net

Fintech examples in banking fintech is equipping the banking industry with tools that makes it more efficient than ever before. Through the leading fintech apps, fintech companies provide consumers to go online and see their financial transactions. Fintech is an industry made up of companies that use technology to make financial services more efficient. As a result, interest in investing.

Source: fintechnews.ch

Source: fintechnews.ch

Top three companies for fintech lending software. Some examples of fintech are mobile banking, mobile payments, trading, cryptocurrency,insurance, trading, lending to name a few. Wayfair, nordstrom and spending tree are just a few of the companies that use suplari’s platform to analyze, predict and cut down on costs. They enable businesses or individuals to conveniently use one location to pool..

Source: merixstudio.com

Source: merixstudio.com

It provides payment services to about 3.500 businesses, including facebook, uber, and airbnb. Blockchain and cryptocurrency serve as the most important examples of what fintech exactly is. As we know, it’s a mix of the words finance and technology. German neobank n26 is no stranger to fintech. The bank has developed personalized insights about.

Source: thestreet.com

Source: thestreet.com

What are examples of fintech? Those that serve consumers directly and those that serve businesses and government organizations. As one of europe’s fintech unicorns, the company knows the value of building quickly using partnerships and collaboration. Here are different types of software you can build for the lending category. For example, to encourage innovation, asic established a regulatory sandbox to.