It is usually done online due to the easy accessibility to a vast network of people. Some of the promising fintech startups in indonesia include jurnal, cashlez, tunaikita, payfazz, and koinworks.

Top Fintech Companies In Indonesia, Payments, lending, wealth management, insurtech, neo banking, and blockchain are all examples of fintech segments. One popular fintech all around the world is crowdfunding.

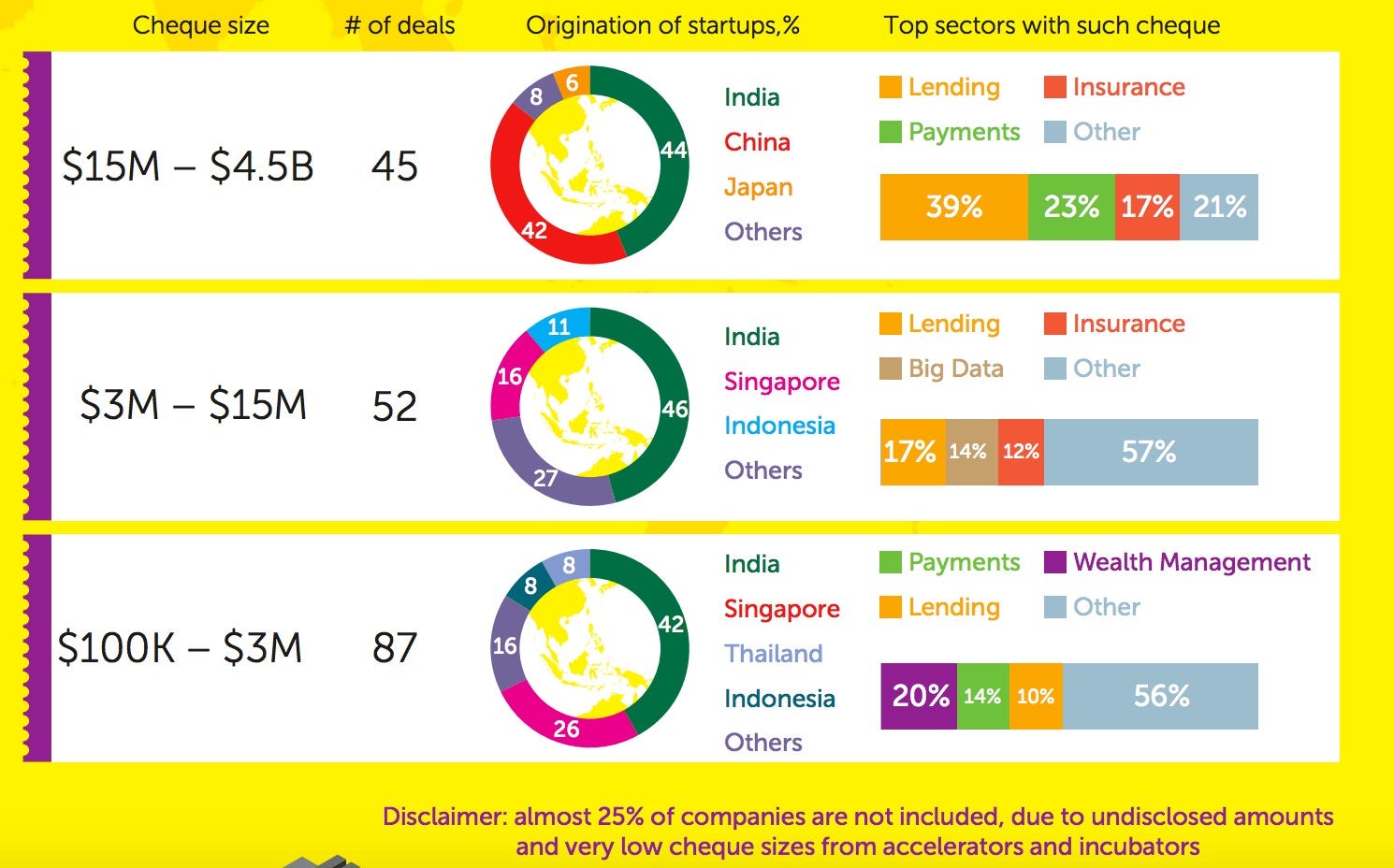

Linkaja, pasarpolis, payfazz, modalku, investree, and ayoconnect were some of these companies. As of 2018, more than 167 fintech companies were registered, according to fintech indonesia 2018 report. Fintech companies in the growth stage (series b and series c) raised almost 84% of the total funding in indonesia last year. It is a method to finance a project or venture through a large number of usually small individual contributions from the public.

Apa saja 10 perusahaan fintech indonesia?

The growth story of fintech in indonesia. With the company being one of the most exciting indonesian startups to be founded last year. As the government pushes for financial inclusion among its citizens, indonesia is also a witness to the growth story of the fintech companies. Linkaja, pasarpolis, payfazz, modalku, investree, and ayoconnect were some of these companies. The company makes its money through the provision of a fintech platform tailored to the needs of creators, brands, freelancers and agencies. It is a method to finance a project or venture through a large number of usually small individual contributions from the public.

Source: fintechnews.sg

Source: fintechnews.sg

This is a break through in regulating fintech, where it has been excluded from the. One popular fintech all around the world is crowdfunding. Fintech companies in the growth stage (series b and series c) raised almost 84% of the total funding in indonesia last year. The fintech players putting indonesia on the map last year, fintech companies in indonesia.

Source: cbinsights.com

Source: cbinsights.com

The company had a tumultuous 2020 when it was supposed to go public in the world’s largest ipo, which gave the fintech a whopping $313 billion valuation. Fintech, mobile payments, point of sale, small and medium businesses; In indonesia alone, 44% of fintech companies are payment service providers. It is a method to finance a project or venture through a.

Source: fintechnews.sg

Source: fintechnews.sg

List of indonesian alternative agencies for dispute resolution in financial services sector revocation of business license for pt makna mandiri insurance broker revocation of business license for pt bank perkreditan rakyat cita makmur lestari Some of the promising fintech startups in indonesia include jurnal, cashlez, tunaikita, payfazz, and koinworks. It is a method to finance a project or venture through.

Source: fintechnews.sg

Source: fintechnews.sg

Eyeing these numbers and trends, indonesia’s fintech startups are creating innovative technological applications to develop or disrupt the following financial markets: The fintech players putting indonesia on the map last year, fintech companies in indonesia attracted us$515 million in fundraising, a slight decrease of 10.9% from the. The company makes its money through the provision of a fintech platform tailored.

Source: e27.co

Source: e27.co

Apa saja 10 perusahaan fintech indonesia? It creates a distributed network of bank agents in indonesia, who perform financial transactions on behalf of the unbanked and underbanked segments of society. It’s a very broad definition that includes early stage fintech startups, established startups such as stripe, large tech companies such as ant financial, but also financial institutions such as citi.

Source: fintechnews.sg

Source: fintechnews.sg

This article showcases our top picks for the best indonesia based fintech (financial technology) companies. The fintech players putting indonesia on the map last year, fintech companies in indonesia attracted us$515 million in fundraising, a slight decrease of 10.9% from the. Firms operating in indonesia’s fintech industry face challenges because of the emerging nature of the market and its fragmentation..

Source: imagezap.org

Source: imagezap.org

These startups and companies are taking a variety of approaches to innovating the fintech (financial technology) industry, but are all exceptional companies well worth a follow. Upbanx is an indonesian startup that was founded in 2021 and is currently based in jakarta, indonesia. Indonesia’s fintech industry is growing rapidly. Top fintech companies in indonesia. Some of the promising fintech startups.

Source: fintechnews.sg

Source: fintechnews.sg

It is a method to finance a project or venture through a large number of usually small individual contributions from the public. Indonesia is home to about 20% of all fintech companies operating in the asean region. The fintech players putting indonesia on the map last year, fintech companies in indonesia attracted us$515 million in fundraising, a slight decrease of.

Source: fintechnews.sg

Source: fintechnews.sg

The company has since diversified its services and established a. As of 2018, more than 167 fintech companies were registered, according to fintech indonesia 2018 report. In indonesia alone, 44% of fintech companies are payment service providers. In general, banking and financial services have a low penetration in indonesia. Payfazz is a fintech startup that was established in 2016.

Source: fintechnews.sg

Source: fintechnews.sg

Bagi anda yang belum mengenal apa itu sektor fintech, mungkin kini saatnya anda belajar mengenalnya. List of indonesian alternative agencies for dispute resolution in financial services sector revocation of business license for pt makna mandiri insurance broker revocation of business license for pt bank perkreditan rakyat cita makmur lestari The fintech players putting indonesia on the map last year, fintech.

Source: techinasia.com

Source: techinasia.com

It’s a very broad definition that includes early stage fintech startups, established startups such as stripe, large tech companies such as ant financial, but also financial institutions such as citi or prudential. Looking at fintech lending’s untapped markets, most investors in indonesia (as well as regional) are confident about fintech lending’s growth for at least the next three years. With.

Source: fintechnews.sg

Source: fintechnews.sg

With over 167 companies operating in indonesia, the fintech market has grown by 16.3% with total investment in fintech companies reaching $176.75 million in 2017. As of may 2019, 249 fintech companies were found in indonesia, and the number is expected to continue growing in the years to come. It’s a very broad definition that includes early stage fintech startups,.

Source: fintechnews.sg

Source: fintechnews.sg

The company had a tumultuous 2020 when it was supposed to go public in the world’s largest ipo, which gave the fintech a whopping $313 billion valuation. The company has since diversified its services and established a. Indonesia is home to about 20% of all fintech companies operating in the asean region. Indonesia’s fintech industry is growing rapidly. At cfte,.

Source: fintechnews.sg

Source: fintechnews.sg

Ant group ($78 billion) ant group, also known as ant financial or alipay, is a fintech giant from china and an affiliate company of the alibaba group. Fintech companies in the growth stage (series b and series c) raised almost 84% of the total funding in indonesia last year. Payfazz is on a mission to empower smes and the rural.

Source: irishtechnews.ie

Source: irishtechnews.ie

In general, banking and financial services have a low penetration in indonesia. The company has since diversified its services and established a. It creates a distributed network of bank agents in indonesia, who perform financial transactions on behalf of the unbanked and underbanked segments of society. The company had a tumultuous 2020 when it was supposed to go public in.

Source: fintechnews.sg

Source: fintechnews.sg

Indonesia is home to about 20% of all fintech companies operating in the asean region. As of 2018, more than 167 fintech companies were registered, according to fintech indonesia 2018 report. Online lending and payments dominate the country’s local fintech sector, as they represent around 60% and. As of may 2019, 249 fintech companies were found in indonesia, and the.

Source: fintechnews.sg

Source: fintechnews.sg

Linkaja, pasarpolis, payfazz, modalku, investree, and ayoconnect were some of these companies. As of may 2019, 249 fintech companies were found in indonesia, and the number is expected to continue growing in the years to come. Some of the promising fintech startups in indonesia include jurnal, cashlez, tunaikita, payfazz, and koinworks. Online lending and payments dominate the country’s local fintech.

Source: fintechnews.sg

Source: fintechnews.sg

The fintech players putting indonesia on the map last year, fintech companies in indonesia attracted us$515 million in fundraising, a slight decrease of 10.9% from the. These startups and companies are taking a variety of approaches to innovating the fintech (financial technology) industry, but are all exceptional companies well worth a follow. Looking at fintech lending’s untapped markets, most investors.

Source: fintechnews.sg

Source: fintechnews.sg

Payfazz is a fintech startup that was established in 2016. In indonesia alone, 44% of fintech companies are payment service providers. Bagi anda yang belum mengenal apa itu sektor fintech, mungkin kini saatnya anda belajar mengenalnya. Fintech, mobile payments, point of sale, small and medium businesses; At cfte, our definition of fintech is “the impact that technology has in transforming.

Source: fintechnews.sg

Source: fintechnews.sg

In indonesia alone, 44% of fintech companies are payment service providers. Upbanx is an indonesian startup that was founded in 2021 and is currently based in jakarta, indonesia. As of may 2019, 249 fintech companies were found in indonesia, and the number is expected to continue growing in the years to come. Fintech companies in the growth stage (series b.

Source: fintechnews.my

Source: fintechnews.my

It is usually done online due to the easy accessibility to a vast network of people. Eyeing these numbers and trends, indonesia’s fintech startups are creating innovative technological applications to develop or disrupt the following financial markets: Financial technology (fintech) is rapidly growing in indonesia. This article showcases our top picks for the best indonesia based fintech (financial technology) companies..

Payments, lending, wealth management, insurtech, neo banking, and blockchain are all examples of fintech segments. A large and fast growing population online and using mobile phones. Ant group ($78 billion) ant group, also known as ant financial or alipay, is a fintech giant from china and an affiliate company of the alibaba group. These startups and companies are taking a.

Source: fintechnews.sg

Source: fintechnews.sg

Payfazz is a fintech startup that was established in 2016. Harshil and shashank founded razorpay in 2014 after discovering that conventional payment gateways were challenging to integrate. Online lending and payments dominate the country’s local fintech sector, as they represent around 60% and. Payments, lending, wealth management, insurtech, neo banking, and blockchain are all examples of fintech segments. It is.

Source: fintechnews.sg

Source: fintechnews.sg

At cfte, our definition of fintech is “the impact that technology has in transforming the financial industry”. Some of the promising fintech startups in indonesia include jurnal, cashlez, tunaikita, payfazz, and koinworks. It’s a very broad definition that includes early stage fintech startups, established startups such as stripe, large tech companies such as ant financial, but also financial institutions such.

Source: fintechnews.sg

Source: fintechnews.sg

It is a method to finance a project or venture through a large number of usually small individual contributions from the public. Firms operating in indonesia’s fintech industry face challenges because of the emerging nature of the market and its fragmentation. With the company being one of the most exciting indonesian startups to be founded last year. Some of the.