But payments, as an african problem, will hardly be solved by one or two companies considering the fragmentation of markets. Its managing director edmund higenbottam joined us to talk about the rise of the sector and its attractiveness to investors.

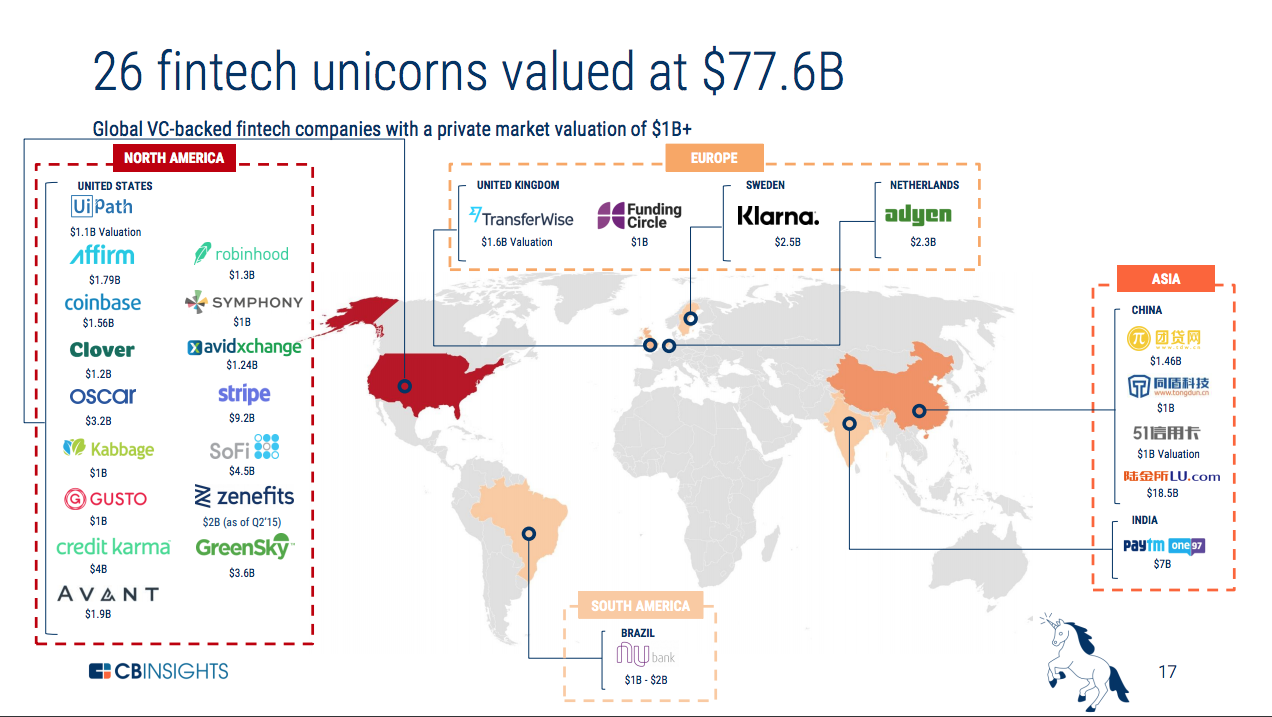

Biggest Fintech Companies In Africa, This article showcases our top picks for the best south africa based fintech (financial technology) companies. Top fintech companies of 2020 by cb insights.

Fintech refers to the integration of technology into offerings by financial services companies in order to improve their use and delivery to consumers. Top fintech companies of 2020 by cb insights. Nigeria’s flutterwave becomes africa’s biggest fintech startup, surpasses $3 billion valuation the payment company secures $250 million in another round of funding. Two of the biggest african fintech acquisitions in 2020 involved payments companies.

During the global pandemic lockdown last year, the fintech firm experienced stellar growth as the value of its gross transactions increased by 4.5x to over $2 billion in december 2020.

Jumo is the biggest fintech that provides banking services to south africa’s population that doesn’t use banks through the jumo digital app. Nigeria’s flutterwave becomes africa’s biggest fintech startup, surpasses $3 billion valuation the payment company secures $250 million in another round of funding. Fintech company in the business of developing technology based solutions that impact how customers interact with money. Known to be one of if not south africa’s biggest online payment gateways, it was set up to make online transactions simple, secure, and accessible to all south african sellers and buyers. It’s a very broad definition that includes early stage fintech startups, established startups such as stripe, large tech companies such as ant financial, but also financial institutions such as citi or prudential. Since its founding, jumo has expanded beyond the south african market and has spread out to other countries like kenya.

Source: netguru.com

Fintech has the highest penetration in south africa, with 94% of individuals having regular access to the internet. Fintech companies are also receiving impressive evaluations, presumably due to the high valuations for fintech worldwide. Due to the low coverage of traditional financial services in africa, the fintech sector has grown significantly in recent years. Meanwhile, branch, a nigerian mobile lending.

Source: cbinsights.com

Source: cbinsights.com

The company had a tumultuous 2020 when it was supposed to go public in the world’s largest ipo, which gave the fintech a whopping $313 billion valuation. Nigerian fintech onefi acquired mest alumni amplify earlier this year. Fintech will keep opening the door to greater financial inclusion. Ant group ($78 billion) ant group, also known as ant financial or alipay,.

![]() Source: techcrunch.com

Source: techcrunch.com

In 2018, kenya’s bitpesa acquired spanish fintech transferzero while egypt’s tpay acquired dcbegypt close to 7 years ago. Since its founding, jumo has expanded beyond the south african market and has spread out to other countries like kenya. The first four of them are proud to be among the fintech 250: Two of the biggest african fintech acquisitions in 2020.

Source: kenyanwallstreet.com

Source: kenyanwallstreet.com

It is the reason we. International investors in african fintech companies include visa and network international holdings. Based out of nairobi, nairobi area, kenya. Nigeria’s flutterwave becomes africa’s biggest fintech startup, surpasses $3 billion valuation the payment company secures $250 million in another round of funding. Nigerian fintech onefi acquired mest alumni amplify earlier this year.

Source: maravipost.com

Source: maravipost.com

Nigeria’s flutterwave becomes africa’s biggest fintech startup, surpasses $3 billion valuation the payment company secures $250 million in another round of funding. Fintech companies in nigeria have run from the launch of the psv until today. Jumo is the biggest fintech that provides banking services to south africa’s population that doesn’t use banks through the jumo digital app. The directory.

Source: issuu.com

Source: issuu.com

But payments, as an african problem, will hardly be solved by one or two companies considering the fragmentation of markets. At cfte, our definition of fintech is “the impact that technology has in transforming the financial industry”. Known to be one of if not south africa’s biggest online payment gateways, it was set up to make online transactions simple, secure,.

Source: techgistafrica.com

Source: techgistafrica.com

How many fintech companies are in africa? Of this total 25% are subsidiary group companies of foreign domicile multinationals, 50% have a local origin, 40% are publicly listed, and 60% are privately owned. Its managing director edmund higenbottam joined us to talk about the rise of the sector and its attractiveness to investors. Find below are the list of fintech.

Source: jewishbusinessnews.com

Source: jewishbusinessnews.com

With an underserved sme sector, some fintech companies in nigeria. But payments, as an african problem, will hardly be solved by one or two companies considering the fragmentation of markets. How many fintech companies are in africa? With a track record of superior returns to shareholders, the bank provides a universal set of transactional, investment, lending and insurance services and.

Source: redwire-group.com

Source: redwire-group.com

In this brief, we take a look at the. How many fintech companies are in africa? It’s a very broad definition that includes early stage fintech startups, established startups such as stripe, large tech companies such as ant financial, but also financial institutions such as citi or prudential. But payments, as an african problem, will hardly be solved by one.

Source: africaieg.com

Source: africaieg.com

Fintech company in the business of developing technology based solutions that impact how customers interact with money. The company had a tumultuous 2020 when it was supposed to go public in the world’s largest ipo, which gave the fintech a whopping $313 billion valuation. The 10 most popular fintech companies in africa are: Top fintech companies in nigeria (summary) Percentage.

Source: cbinsights.com

Source: cbinsights.com

Nigeria’s flutterwave becomes africa’s biggest fintech startup, surpasses $3 billion valuation the payment company secures $250 million in another round of funding. Fintech has the highest penetration in south africa, with 94% of individuals having regular access to the internet. Based out of nairobi, nairobi area, kenya. In this brief, we take a look at the. During the global pandemic.

Source: youtube.com

Source: youtube.com

Fintech company in the business of developing technology based solutions that impact how customers interact with money. 67% of south africans have a bank account and mobile phone penetration is over 100 for every 100 people. These startups and companies are taking a variety of approaches to innovating the fintech (financial technology) industry, but are all exceptional companies well worth.

Source: thebasispoint.com

Source: thebasispoint.com

The directory of the biggest fintech startups in africa. Top fintech companies of 2020 by cb insights. It is the reason we. Fintech will keep opening the door to greater financial inclusion. Fintech company in the business of developing technology based solutions that impact how customers interact with money.

Source: netguru.com

Source: netguru.com

Fintech companies are also receiving impressive evaluations, presumably due to the high valuations for fintech worldwide. Due to the low coverage of traditional financial services in africa, the fintech sector has grown significantly in recent years. Nigeria’s flutterwave becomes africa’s biggest fintech startup, surpasses $3 billion valuation the payment company secures $250 million in another round of funding. Fintech company.

Source: urbankenyans.com

Source: urbankenyans.com

Jumo is the biggest fintech that provides banking services to south africa’s population that doesn’t use banks through the jumo digital app. In this list we only provide a sample of. The first four of them are proud to be among the fintech 250: Average founded date oct 18, 2015; Last but not least is one of the most valuable.

Source: irishtechnews.ie

Source: irishtechnews.ie

During the global pandemic lockdown last year, the fintech firm experienced stellar growth as the value of its gross transactions increased by 4.5x to over $2 billion in december 2020. At cfte, our definition of fintech is “the impact that technology has in transforming the financial industry”. Ant group ($78 billion) ant group, also known as ant financial or alipay,.

Source: thefintechtimes.com

Source: thefintechtimes.com

Based out of nairobi, nairobi area, kenya. At cfte, our definition of fintech is “the impact that technology has in transforming the financial industry”. How many fintech companies are in africa? Opay is nigeria’s biggest fintech company, and this is not simply because it is the unicorn with the highest valuation. The company had a tumultuous 2020 when it was.

Source: cbinsights.com

Source: cbinsights.com

International investors in african fintech companies include visa and network international holdings. Meanwhile, branch, a nigerian mobile lending app, raised $260m in funding and has facilitated $350m in loans to date. Fintech company in the business of developing technology based solutions that impact how customers interact with money. Percentage of public organizations 0%; Of this total 25% are subsidiary group.

Source: fintechnews.ae

Source: fintechnews.ae

Fintech companies are also receiving impressive evaluations, presumably due to the high valuations for fintech worldwide. Two of the biggest african fintech acquisitions in 2020 involved payments companies. Ant group ($78 billion) ant group, also known as ant financial or alipay, is a fintech giant from china and an affiliate company of the alibaba group. Known to be one of.

Source: fintechnews.ch

Source: fintechnews.ch

Top fintech companies in nigeria (summary) Opay is nigeria’s biggest fintech company, and this is not simply because it is the unicorn with the highest valuation. The 10 most popular fintech companies in africa are: It is the reason we. Of this total 25% are subsidiary group companies of foreign domicile multinationals, 50% have a local origin, 40% are publicly.

Source: fintechnews.ae

Source: fintechnews.ae

Fintech has the highest penetration in south africa, with 94% of individuals having regular access to the internet. Known to be one of if not south africa’s biggest online payment gateways, it was set up to make online transactions simple, secure, and accessible to all south african sellers and buyers. Jumo is the biggest fintech that provides banking services to.

Source: thefintechafrica.com

Source: thefintechafrica.com

Fintech is revolutionary for the fact it has given economically disadvantaged and unbanked people access to financial services they previously did not have. Its managing director edmund higenbottam joined us to talk about the rise of the sector and its attractiveness to investors. The company had a tumultuous 2020 when it was supposed to go public in the world’s largest.

Source: fintechnews.ch

Source: fintechnews.ch

Two of the biggest african fintech acquisitions in 2020 involved payments companies. Known to be one of if not south africa’s biggest online payment gateways, it was set up to make online transactions simple, secure, and accessible to all south african sellers and buyers. Jumo is the biggest fintech that provides banking services to south africa’s population that doesn’t use.

Source: cbinsights.com

Source: cbinsights.com

It is the reason we. Based out of nairobi, nairobi area, kenya. In 2018, kenya’s bitpesa acquired spanish fintech transferzero while egypt’s tpay acquired dcbegypt close to 7 years ago. Nigeria’s flutterwave becomes africa’s biggest fintech startup, surpasses $3 billion valuation the payment company secures $250 million in another round of funding. Fintech companies in nigeria have run from the.

Source: techcrunch.com

Source: techcrunch.com

In 2018, kenya’s bitpesa acquired spanish fintech transferzero while egypt’s tpay acquired dcbegypt close to 7 years ago. How many fintech companies are in africa? During the global pandemic lockdown last year, the fintech firm experienced stellar growth as the value of its gross transactions increased by 4.5x to over $2 billion in december 2020. Due to the low coverage.